Unwind time.

The selloff we saw from the gap open Monday until basically the close yesterday was mostly a result of investors either liquidating or hedging ahead of the CPI. These positions now need to be unwound quickly.

Now we get to observe what the unwind will be like as we gap over resistance.

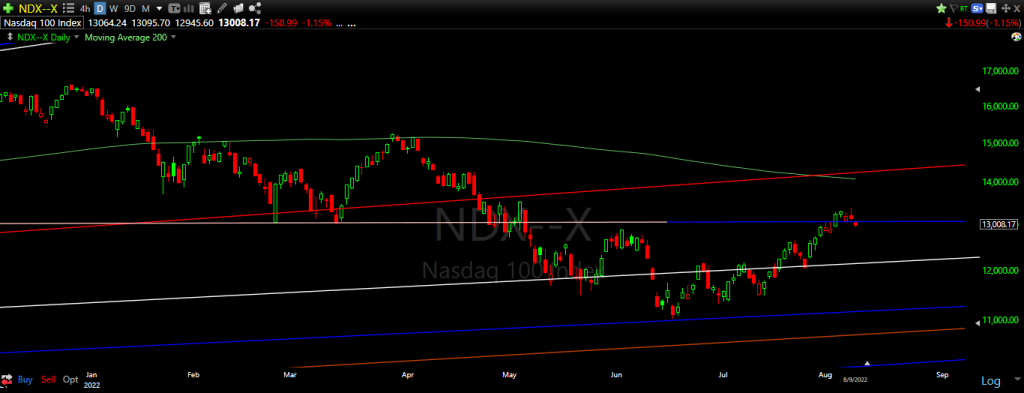

There is a powerful pattern shaping up here on a break of resistance in both the Nasdaq and the S&P.

Should we get follow through into the end of the week, which is what our increased long positions taken prior to the CPI release yesterday are betting on, then August goes back into vertical rip for the remainder of the month mode.

Here is the NDX as we get set to open:

Two steps to rip the still beating hearts from each and every bear’s chest for the remainder of this week:

- Market closes today at or above Monday’s high.

- Market follows through on Thursday and Friday, closing the week well above Monday’s high, confirming the break of resistance.

What this will do is directly target NDX 14,000+ for August. That is an 8% move up from here.

Very doable.

Very realistic in the face of investors who have missed this rally completely, now having to play catch up.

Enjoy the ride.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.