None of this is a coincidence with CPI, PPI and Fed minutes being imminent:

SPX 4109

BTC 30300

10 year yields 3.4%

DXY nearing 100

VIX below 20

All of these key indicators of capital flows are telling us that something has indeed flipped in recent weeks. While most are still stuck in a narrative of recession, bank failures, stagflation and geopolitical turmoil, the market is focusing on something else entirely.

It's not our job to be psychics as investors, pinpointing what that "something else" could be.

Our job as investors is to recognize when price momentum and structure is of the type that is significant enough that it dictates shutting down all emotional traits associated with following group think, and following the smoke signals that price is clearly emitting in the near distance.

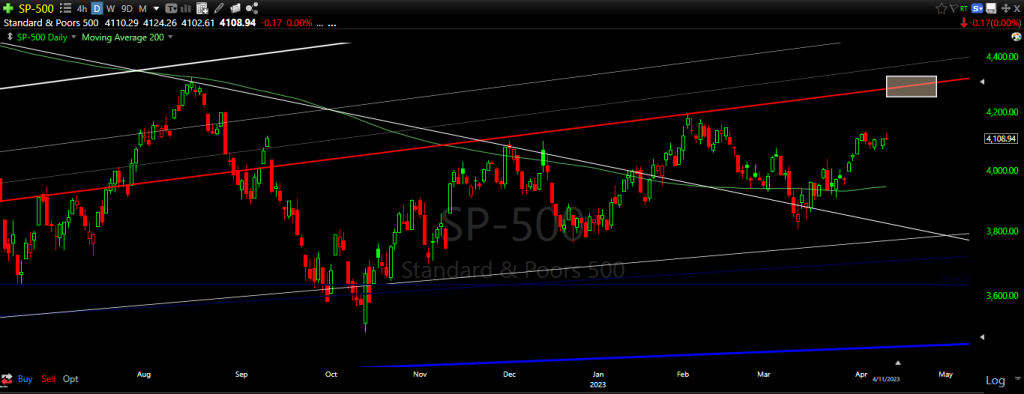

If you will recall, in mid-January with the SPX at 4000, I detailed how investors were focused on the incorrect price levels around 4000, with 4100-4200 being the true point of interest for the markets.

4200 came in early February, stopping the markets cold in their tracks. Investors had their eye on the incorrect target.

Now here we are again, the same mistake is being made.

The SPX has a point of interest at 4300, constituting either resistance (down) or an acceleration zone (up).

4100-4200 no longer matters. The goalposts have been moved.

With that said, for the remainder of this week investors are contending with a bunch of scary economic events (CPI, PPI and Fed minutes) along with perceived technical resistance areas (4100-4200) that carry little weight.

This combination of factors will allow for the markets to quickly move up for the remainder of this week on the back of economic data that will reignite discussions of a dovish pivot.

4300 tells us what the next steps will be.

Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.