As outlined in yesterday's note, there were a handful of subtle clues going into today's Powell speech pointing to a run of this magnitude.

You can find the text of Powell's speech in various places today, I'm not here to summarize what was said.

The bottom line is that we are nearing the end of the rate hike cycle, with the possibility that a 50bp hike in December will be it for rate hikes, barring a final 25bp hike in February.

Markets have been in the process of front running a pause since the October lows.

Here is where the markets stand as of today, beginning with the S&P:

Perfect move up over the 200 day moving average accompanied by a volume spike after a picturesque low volume consolidation.

The recent consolidation only bolsters the argument that 4100 will fall in rapid fashion. I am expecting the SPX to consolidate around 4200 going into the FOMC in a couple weeks. From there, as Powell further rings the dovish bell, a price target of 4500 for the S&P by year end is not at all out of the question.

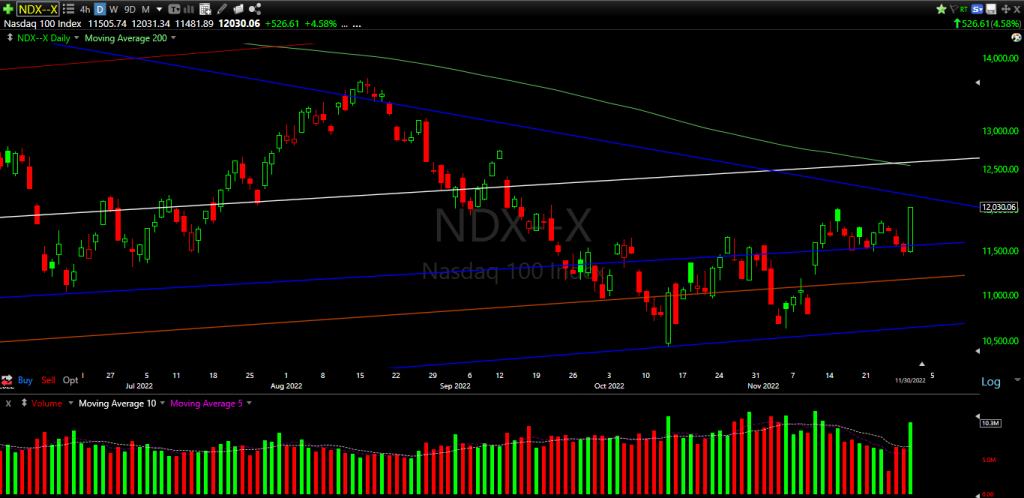

Big volume breakout on the NDX today. Targeting 12500-13000 in the short-term.

Lastly the USD Index:

USD Index (DXY) is on the verge of another major downleg. The economic data over the next couple of days, combined with CPI data due prior to the FOMC decision should aide in getting this down much further, which will bolster risk assets significantly.

Expecting December to set the table for a Q1 that will be shock and awe campaign for equities we have rarely witnessed.

Prepare accordingly.

Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.