While gold is primarily considered a currency and a safe haven asset, silver is much more an industrial metal. For this reason, the economic sensitivity that silver possesses is a relevant consideration when investing. During periods of global recession, while gold may outperform, silver will typically lag. This is the primary reason why silver has lagged in recent months while gold is up nicely.

Any type of indication that global economies, especially those of an emerging nature, are not dipping into a recessionary territory should cause silver to narrow the gap in value between gold substantially. Conversely, should the global economy actually move towards the recessionary route, silver is already discounted to a point where the downside will be cushioned. This is especially true in light of what has a high probability of being continued outperformance in gold, global recession or not.

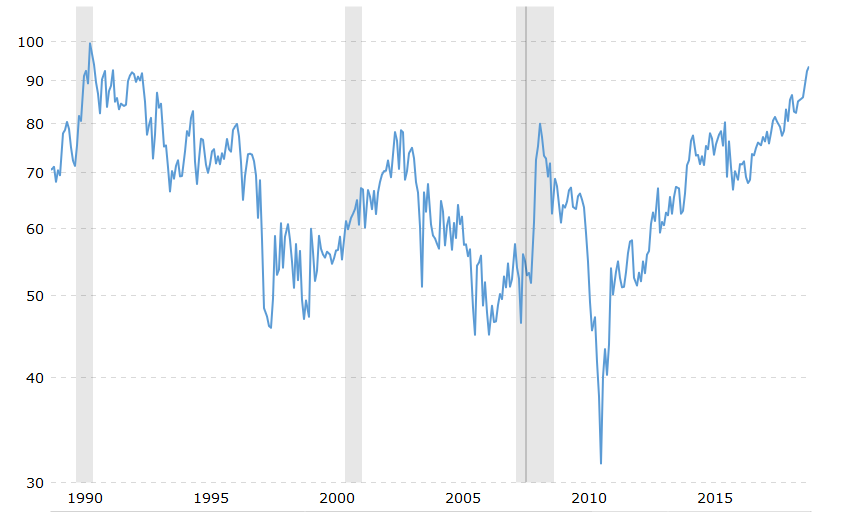

In the chart above, we have a 30 year historical perspective on the ratio between gold and silver. As we stand currently, the ratio of value between gold and silver is at its highest point in 30 years. Scrolling further back, it is in fact at one of its highest points in value of the past 100 years.

This type of anomalous condition will be resolved in one of two ways:

1. Gold goes down

2. Silver goes up

Given the recent strength in gold, with a host of macro factors working in its favor, the probability of gold moving down to narrow the spread is unlikely. Instead, it should be silver that narrows the spread with a move up over time.

Any indication of vitality in the global economy for the remainder of the year has the potential to quickly cause investors to recognize the discrepancy taking place in silver, creating a substantial increase into year end. With global bond investors misallocated into mostly negative yielding fixed income assets, there is plenty of firepower on the sidelines remaining to invest in both emerging and developed markets for the remainder of 2019. These are latent bids that will be have a reflexive effect, reinforcing any positive momentum in global economic growth, as it becomes apparent in the months ahead.

During the next leg of the metals bull market, silver has a high probability of not only refusing to take a back seat to a gold rally, but actually leading the rally higher. This has everything to do with progressive stages of a bull market further unleashing animal spirits into assets perceived as riskier in nature, as well as a high probability of a China deal and the accompanying surge in the global economy negating the bearish silver argument completely.

Enjoy the trade.

Zenolytics now offers Turning Points and ETF Pro premium service Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.