Every day I go through roughly 200 stocks/indices/indicators, several times per day, looking for signals, attempting to connect dots and ultimately, hoping to find risk/reward situations that create outperformance.

The title Lies, Damn Lies seems appropriate as when the markets want to reveal any kind of truth, they first do so through blatant lies. Conversely, whenever truth appears apparent, there is likely to be deception involved. In other words, markets are a thief and must be treated like one whenever attempting to interpret their message.

These are simply thoughts (some completely random) as I attempt to connect the dots:

- The S&P is on track to have one of its worst quarterly performances ever. As of today, it stands as the 14th worst quarter for the S&P in market history with a loss of 17%. Without going back into the Great Depression years, here is what happens the next quarter after experiencing despondent annihilation in the previous quarter:

Q3 2002 -17% Q4 +10%

Q2 1970 -18% Q3 +11%

Q3 1946 -18% Q4 +3%

Q2 1962 -21% Q3 +3%

Q4 2008 -22% Q1 -13%

Q4 1987 -23% Q1 +3%

Q3 1974 -25% Q4 +1%

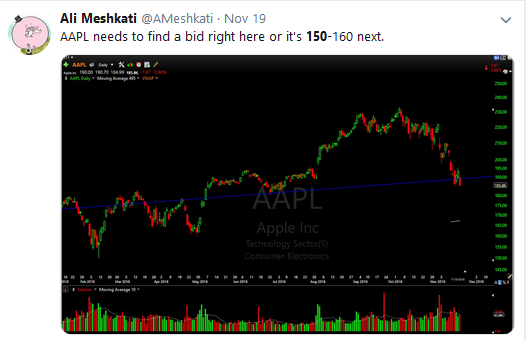

- In November I said that the downside on Apple was 150-160. After witnessing the price action over the past several weeks, it's now apparent that Apple will move below 100 at some point in 2019. Perhaps far below.

- There doesn't seem to be a chance in hell AMZN can escape all of this without moving back into the triple digits. It will bounce with the rest of the market. However, in 2019 it will have a 9 handle and then perhaps 8 or 7.

- Private equity firm ARES is highly susceptible to a slowdown in the business cycle as they are heavily involved in CLOs to businesses that have become popularized due to the fees enjoyed by those who participate. Economic downside will turn those companies exposed to these assets into one-eyed zombies. Here is a recent Bloomberg piece describing the absurdity of it all https://www.bloomberg.com/graphics/2018-collateralized-loan-obligations/

- BABA is a terrific short candidate on any future rallies. I'm increasingly compiling a list of companies to short in 2019 when the market strengthens. This is a top of the list candidate.

- BRKB could be headed to 130 in the next 6-12 months. Another short candidate.

- While I don't like the dilution in BTG, it's an attractive name in the gold sector. Like other miners, their management is paid far too much and they dilute shareholders ad infinitum. Don't own it. Already have our favorite name in the sector, but BTG is an attractive option.

- Looks like the Nasdaq Comp is headed towards 5900. If that level fails with any voracity whatsoever, then the next level becomes 4900. I would expect a bounce to start from around the 5900 level (or a tad bit lower), however, sometime in the middle of January.

- Support on the Dow sits at 20,200 and then at 19,100. All of the support areas for the markets are now considerably lower given how treacherous the markets have been when confronted with any support whatsoever. It has been like a hot knife through butter all month.

- FB has the look of its 2015 bullish momentum beginnings in reverse with this move down. A slow, steady grind down over the next couple years should be expected. There is not a price target too low for this company.

- Gold continues to have that steady creepin' look that will consistently throw everyone off throughout this move up. It's already been doing that as I've read numerous "studies" as to why the price should move back down soon. In terms of risk/reward, there is nothing that compares except for silver possibly. However, there are economic factors at work in the silver market that make it a lot more dynamic of an investment.

- GOOG embodies the entire FANG complex and all the satellite names you can lump in. They look completely wrecked. Sideways is a best case scenario for these names over the next couple years. More than likely, substantial downside.

- MSFT looks to be headed to roughly 85. It could happen over the next couple weeks as the window for the markets to rally has closed, as I touched on earlier today.

- SFTBY is a favorable short opportunity on any future rallies. It is levered to everything that can go wrong during an economic downturn with an opaque, difficult to value structure as an added bonus. These types of names are frowned upon during downcycles.

- Silver looks like a coiled 14 foot snake that can extend further than anyone expects over the next several weeks.

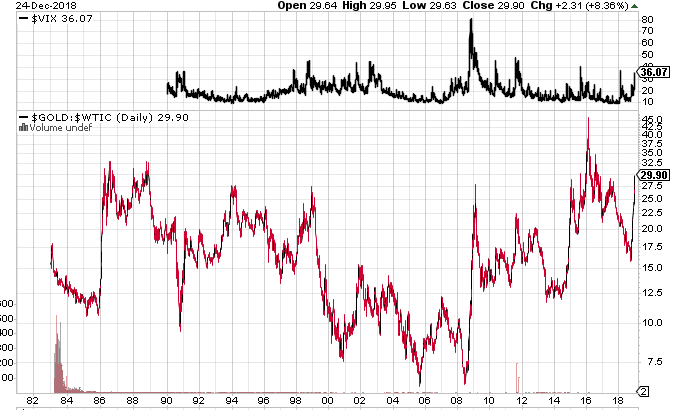

- Gold to oil ratio has a significant correlation to the VIX. In other words, it's an additional tool to have at one's disposal in order to quantify risk at extremes. Since we are at extremes here, I thought I would point it out. Here is the chart with the VIX on top. Notice that during the last substantial decline in early 2016, the ratio made a multi-decade high as oil prices slipped while gold ran to the upside. That high may be exceeded to a degree in coming weeks.

_______________________________________________________________________________

From time to time, I email individual company research, commentary and excerpts from my monthly investor letter to those who are interested. If you would like to receive future emails, please write me at mail@T11Capital.com

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.