ARE THE TRUMP TRADES IN THE BEGINNING STAGES OF BEING UNWOUND?

It always seemed fairly obvious that the markets, for better or worse, would test the entire thesis behind all the Trump trades investors put on after he was elected. From yields, to financials, to the US Dollar, every single perception of what should thrive under the capitalist orgy that is the Trump administration would be put the test.

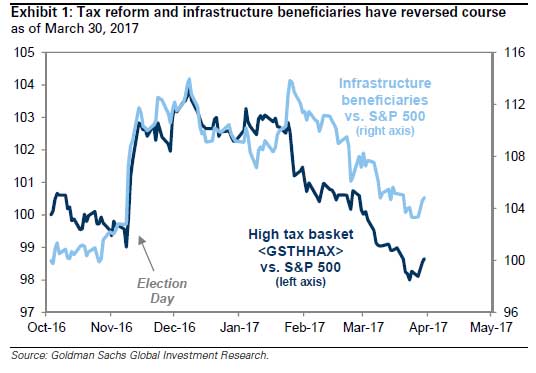

Already some of the "no-brainer" stocks that would benefit the most from Trump have unwound. Surprisingly enough, some have completely unwound. Below is a chart of high tax companies that have the most to gain from aggressive tax cuts, plotted side by side with infrastructure beneficiaries.

Both of these baskets have unwound their post-election gains completely, with the high tax basket actually showing a loss since election day as of March 30th.

Something else is just starting to gain momentum, however. Some rather trustworthy macro indicators of economic health that should be thriving if growth prospects brought on by massive fiscal stimulus were indeed true are beginning to look like they want to reverse course.

10 year treasuries are gaining ground while the Fed is in the process of raising the Fed Funds rate. Bond investors seem to think that economic growth prospects are tepid at best moving forward.

click chart to enlarge

And then we have Copper, a leading indicator of economic activity that seemed to love Trump during November up to February, but is now deciding that perhaps the need for material for infrastructure projects won't be coming to fruition anytime soon.

Finally, financials have been an enormous beneficiary of all the promises of deregulation ushering in what will perhaps be a golden age for the sector in the years ahead. Yet, there has been some lag as of late and suddenly, financials look like they are perfectly content skipping the formalities of any golden age that has been promised.

All of this, at the very least, warrants close watch in the weeks ahead as geopolitical fears become amplified, earnings come in fast and furious and the threat of a government shutdown into the end of the month looms.