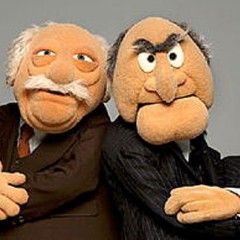

OCTOBER WAS A CURMUDGEON

The 4% plus gain the S&P 500 managed to glue together for October was a bit deceiving. October was a curmudgeon anyway you look at it. In fact, it was difficult enough that you could get the direction of the market right, but still end up with a flat month. This was the first time in 5 months that my managed portfolios underperformed the S&P 500. They did it in spectacular fashion, allowing a near 500 basis point catch up for the S&P. Nobody cared about my investments during October. That’s the gist of what occurred. I sat and watched what amounted to a snails pace trajectory of lowered bids and offers. CIDM, which managed a 19% gain for the month, couldn’t gain its footing beyond one vertical day which caused a majority of the gains. The company announced that it is on its way to becoming a leader in the world of digital entertainment to a chorus of crickets. That’s what a 19% gain is in contrast to their merger and glistening new business model. The tone of the CEO alone during the conference call following the merger announcement made me want to keep clicking the buy button until my mouse broke. But then I remembered he was just granted a tidy stock compensation package just a month before the merger was announced. Not a coincidence. In fact, it is a testimony to the fact that he knew following this merger the stock wouldn’t see 1.50 again, which is the strike price of his options. It’s a transformative move. Management knew it. And I think they expected more pop in the price to at least $2 by this point. I know I did. The S&P got a chance to catch up to me this month. But who was leading that parade? And is it a parade that I should be jealous of not being invited to or glad that I didn’t get an invitation? Let’s look at the leaders over the past month: - Greece was up 19% - Basic materials were up 5% for the month - Real estate index up 4% for the month - Healthcare was another leading gainer - Utilities and Consumer Goods round it out Big cap tech and retail were also in that list. As we all know, big cap tech was selective and choppy during the month. The rotation from the new school of momentum into the old school of momentum caught a lot of investors off-guard. Once in awhile a retiree that reads Investor’s Business Daily religiously is going to make me look like a rank amateur just by sitting on...

THOUGHTS ON DAN LOEB, FACEBOOK, THE CURRENT MARKET, THE FUTURE MARKET AND LESSONS OF THE PAST

- A pretty scathing article about Dan Loeb published in the December issue of Vanity Fair. I knew Dan Loeb before he was Dan Loeb, instead referring to himself as Mr. Pink. Mr. Pink was active on the Silicon Investor message boards in the 90s, having a good sized following among investors. Even back then, he was as abrasive as anybody you would ever come across. Message boards in the 90s were like the Twitter of today. In fact, I often think of Twitter as the modern version of the message board. The Dan Loeb of the 90s was a talented individual. He broke down the case for investing on both the long side and the short side of companies in a well thought out manner. His analysis was typically accurate. You could immediately tell that he got a certain joy out of shorting small-cap names that had a questionable management team or operation in place. He did go after incompetent and in some cases, criminal management teams. He did have help in discovery, however. There were others that participated in the same game of overthrowing supposedly corrupt CEOs. Most notably, Anthony Elgindy aka Anthony@Pacific on Silicon Investor. Mr. Pink and Anthony@Pacific did have a fairly healthy online relationship before Mr. Elgindy was convicted and sentenced to many years in prison for a bunch of financial related crimes. He was recently released, I believe. It seems that with all the enemies Dan Loeb has made over the years, we may be in the process of witnessing the good old American sport of “bring you up just to tear you down,” with this Vanity Fair article kicking off the parade. Pretty sad if this is the intention, as I think whatever success he has achieved he does deserve, regardless of whether or not you agree with his “pull no punches” investment methodology. - If you are a believer in the FB/YHOO correlation study (I don’t know why anyone wouldn’t be at this point given how accurate it has been in calling FB from the middle of last year), then this is for you. According to that study, Q4 for FB should be flat. I would say a range between 45-55, which is what the stock has been carving out here recently. According to the study, FB should begin moving up again in Q1 2014, headed for close to $100 before the end of 2014. - If you are a believer in October ending badly, then I have something for you too. Today was bearish anyway you look at it. The action in the Russell was especially atrocious. The action in the S&P wasn’t...